My friend told me that when he was 25 years old, he made his first pot of gold, about 1 million. I’m already depressed to the end, I don’t know what to do, so I asked ChatGPT, he told me the following things, how to make my first money maybe to millionaire.

Defying the Myth of Impossibility

The notion that becoming a millionaire is an unachievable dream is far from the truth. According to recent data from Moneyzane, there are currently over 51.1 million millionaires worldwide, accounting for more than 1% of the global adult population. Remarkably, approximately half of them reside in the United States. This statistic reveals that not all millionaires won the lottery or were born into wealth. A study conducted by Wealth-X in 2019 found that 68% of individuals with a net worth of $30 million or more are self-made. This serves as undeniable proof that with the right mindset and strategies, you too can attain millionaire status.

Unlocking the Power of Expertise and Entrepreneurship

The first step towards millionaire status is to develop expertise in a high-demand area or embark on the entrepreneurial journey. In today’s rapidly evolving world, it is crucial to offer skills or solutions that people are willing to pay a premium for. Consider honing your abilities in areas such as app development, problem-solving, or niche market products. By leveraging your skills, you can create a successful business model or monetize a popular app. Business ventures and investments are the primary vehicles through which wealth can flourish, unless you have the privilege of being a CEO of a renowned company like Google.

Mastering Financial Discipline for Long-Term Prosperity

A common misconception is that living below your means equates to a life devoid of enjoyment and indulgence. However, in reality, it is a practical and essential approach to achieving financial stability. In an era marked by economic uncertainties, rising prices, and potential job cuts, it has never been more crucial to manage your finances wisely. Begin by creating a budget and striving to stay within its limits. While it may be challenging initially, remember that small deviations are acceptable. Analyze your expenditures over a month and identify areas where you can curb unnecessary spending on overpriced items, club memberships, or excessive dining and drinking. It is vital, however, not to deprive yourself entirely. Treat yourself occasionally to maintain balance and preserve your sanity. Avoid accumulating high-interest debt, and minimize the use of credit cards that can lead to exorbitant interest payments.

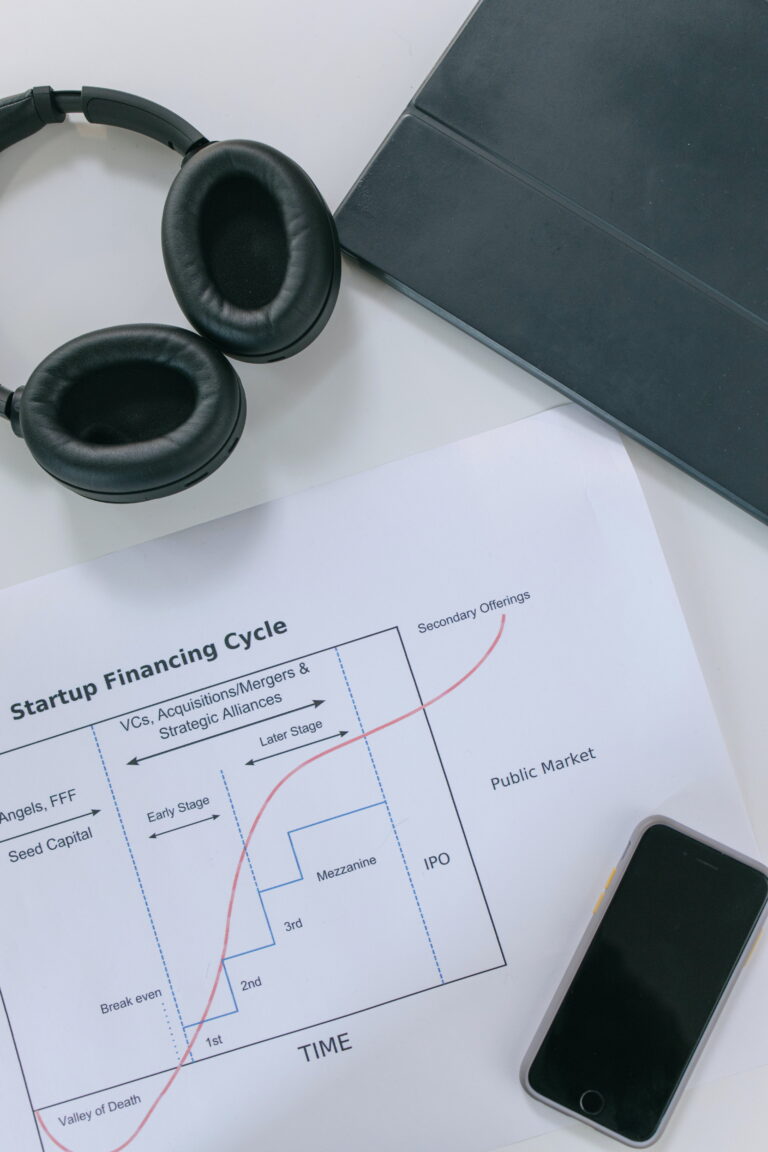

Maximizing Returns and Nurturing Financial Growth

Once you have accumulated savings, it is crucial to put them to work rather than letting them depreciate over time. Idle cash holds little value in the long run. Instead, consider investing in your own business or creating a diversified investment portfolio. Begin by assessing your risk tolerance, which may vary depending on your age and financial goals. If you are young, taking calculated risks is reasonable, while a more conservative approach may be advisable if you are approaching middle age or beyond. Regardless of your risk tolerance, diversifying your investment portfolio is key. Educate yourself about different investment options such as stocks, bonds, mutual funds, real estate, and options. Start small if you are new to investing, gradually increasing your investments as you gain experience and confidence. However, it is important to note that relying solely on ChatGPT for investment advice is not recommended.

Cultivating Habits for Long-Term Success

Embarking on the journey to millionaire status requires unwavering focus and commitment. Motivation may fade over time, but consistency builds momentum and becomes a powerful habit. Set clear goals and prioritize tasks that align with your financial aspirations. Eliminate trivial distractions and tackle small tasks first, clearing the path for more significant endeavors. Consider adopting productivity techniques such as the Pomodoro technique, where you work for focused intervals and take short breaks in between. Breaking down larger tasks into smaller manageable pieces also aids in efficient workload management. Furthermore, prioritize your health, as wealth means little if you neglect your well-being. If the pressure becomes overwhelming, take a break and rejuvenate yourself by exploring new places. Remember, you are a human being, not just an AI assistant.

The Virtue of Persistence and the Power of Connections

Becoming a millionaire is not an overnight achievement. It requires patience, discipline, and a long-term perspective. Let’s do some quick math: if you save $3,000 monthly and experience a 15% compound return, it would take approximately ten years to accumulate a million dollars. Understand and embrace the fact that the road to wealth is a journey, and success comes to those who persevere.

Embrace the Challenge and Unlock Your Potential

Becoming a millionaire is a realistic goal within your grasp. By developing high-income skills, living below your means, investing wisely, and maintaining focus and commitment, you can pave your own path to financial freedom. Remember that the journey may have its ups and downs, but with patience, perseverance, and a strong network, you can overcome obstacles and achieve the wealth you desire. So, embark on this adventure with determination, seize opportunities, and may success be your constant companion. Best of luck on your journey to becoming a millionaire!

+ There are no comments

Add yours